Table I from Discussing on Trend to Efficient Market Hypothesis of Securities and Futures Market | Semantic Scholar

Stock Investment and Excess Returns: A Critical Review in the Light of the Efficient Market Hypothesis

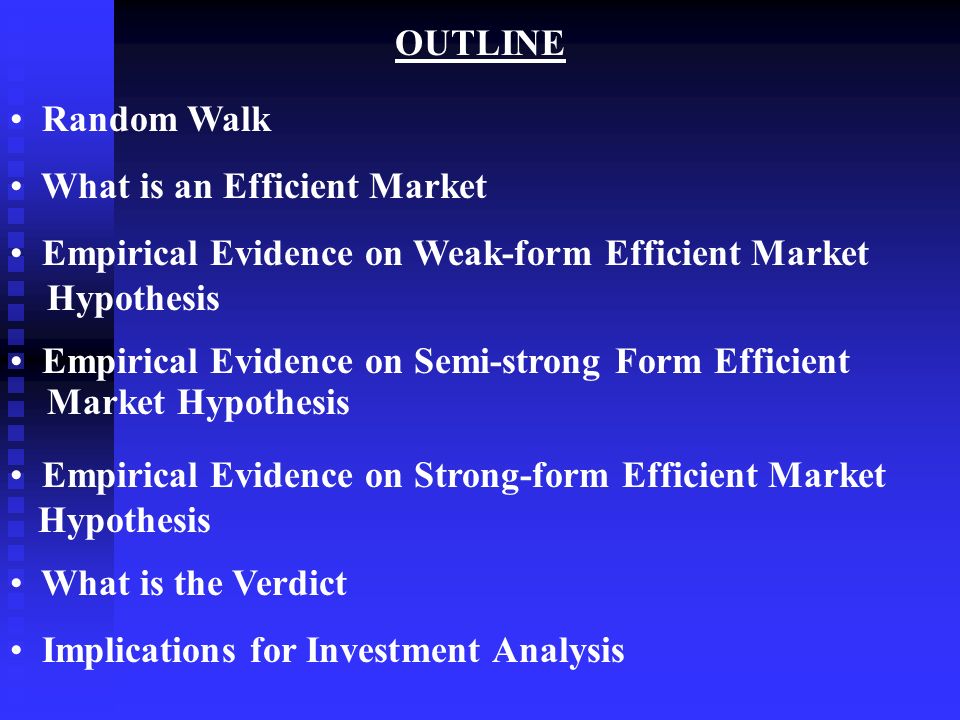

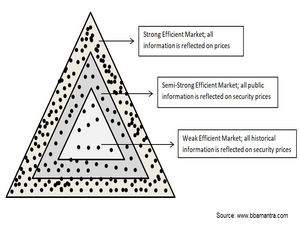

CHAPTER 11 The Efficient Market Hypothesis. Topics Definition of Market Efficiency –Random walk process –Rapid price adjustment –Incapable of beating. - ppt download

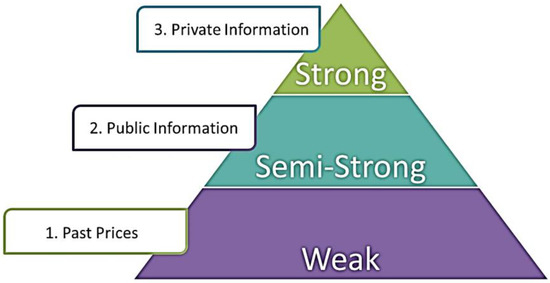

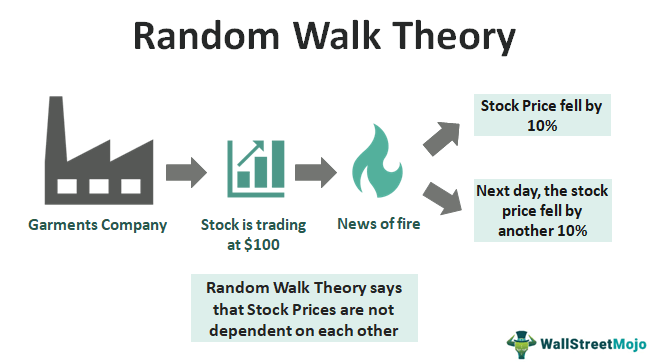

The Efficient Market Hypothesis Random Walks and Efficient Market Hypothesis Random Walk Notion that stock price changes are random Efficient Market. - ppt download

Efficient Market Hypothesis vs. Random Walk Theory vs. Stock Market Reality: Learn Stock Investing. - YouTube

Tests of Random Walk and Efficient Market Hypothesis in Developing Economies: Evidence from Nigerian Capital Market | International Journal of Management Sciences IJMS - Academia.edu

What is the exact relationship between the efficient-market and random-walk hypotheses? - Economics Stack Exchange

The Stock Market, the Theory of Rational Expectations, and the Efficient Markets Hypothesis - презентация онлайн