Basic trading strategies using European options (part 1 of 2) | by Diogo de Moura Pedroso | Quant Chronicles | Medium

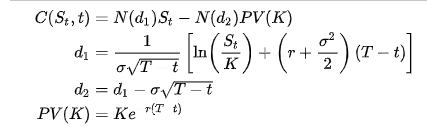

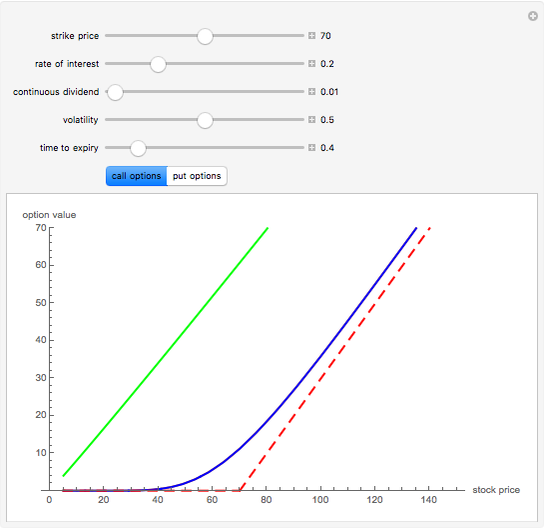

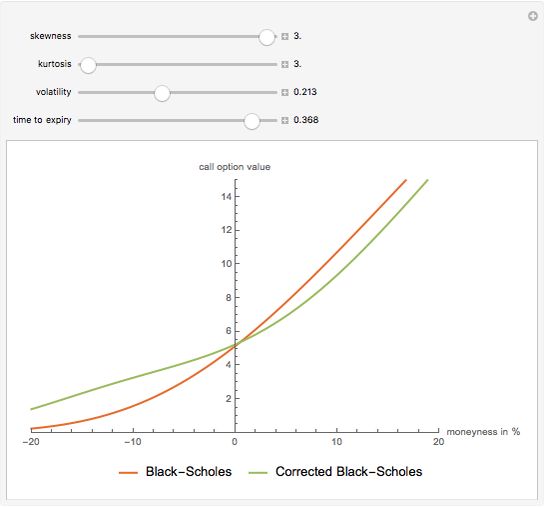

The Black-Scholes European Call Option Formula Corrected Using the Gram-Charlier Expansion - Wolfram Demonstrations Project

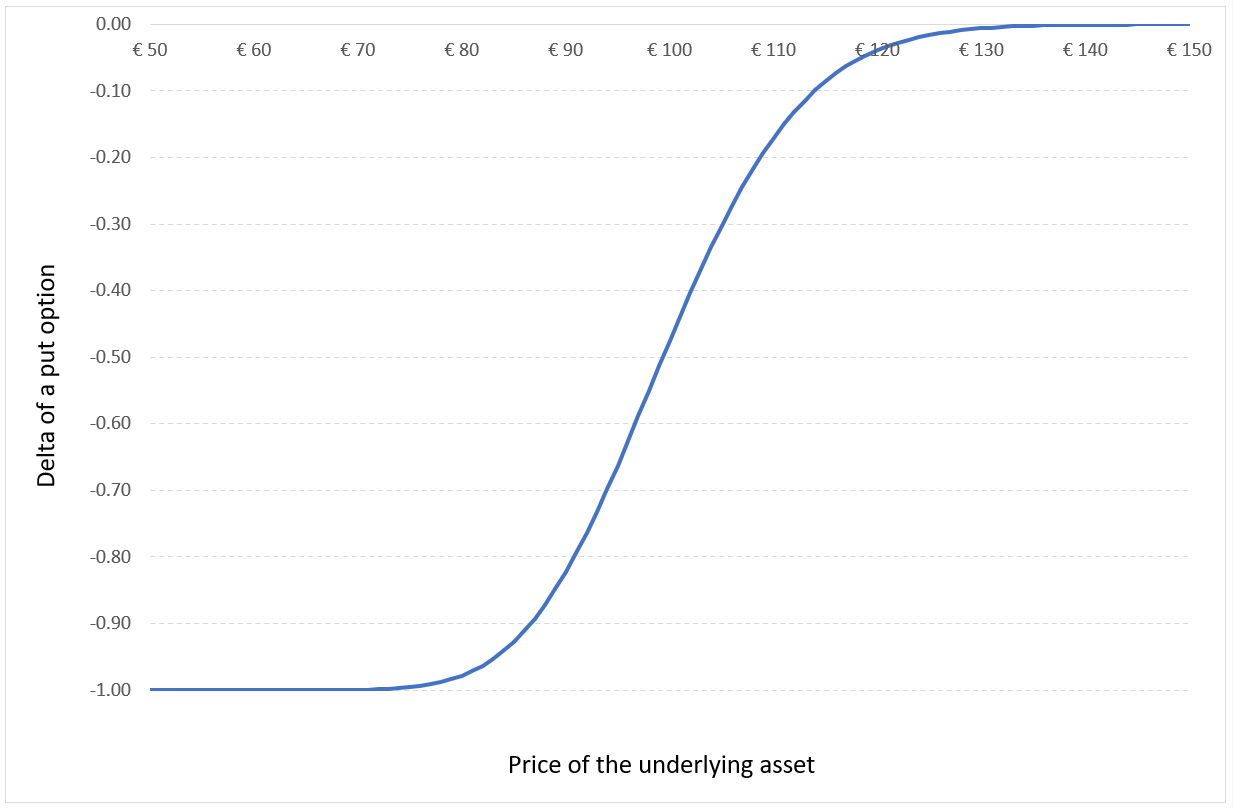

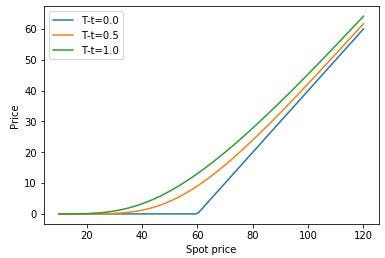

![PDF] NON-UNIFORM FINITE DIFFERENCE METHOD FOR EUROPEAN AND AMERICAN PUT OPTION USING BLACK-SCHOLES MODEL | Semantic Scholar PDF] NON-UNIFORM FINITE DIFFERENCE METHOD FOR EUROPEAN AND AMERICAN PUT OPTION USING BLACK-SCHOLES MODEL | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/e4a1d5afb4ae54a17cea0cd64aceda55e382836e/9-Figure2-1.png)

PDF] NON-UNIFORM FINITE DIFFERENCE METHOD FOR EUROPEAN AND AMERICAN PUT OPTION USING BLACK-SCHOLES MODEL | Semantic Scholar

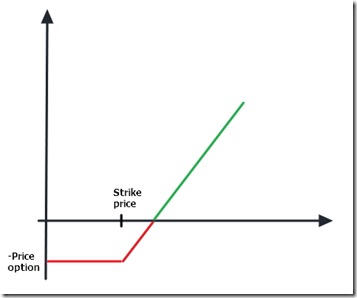

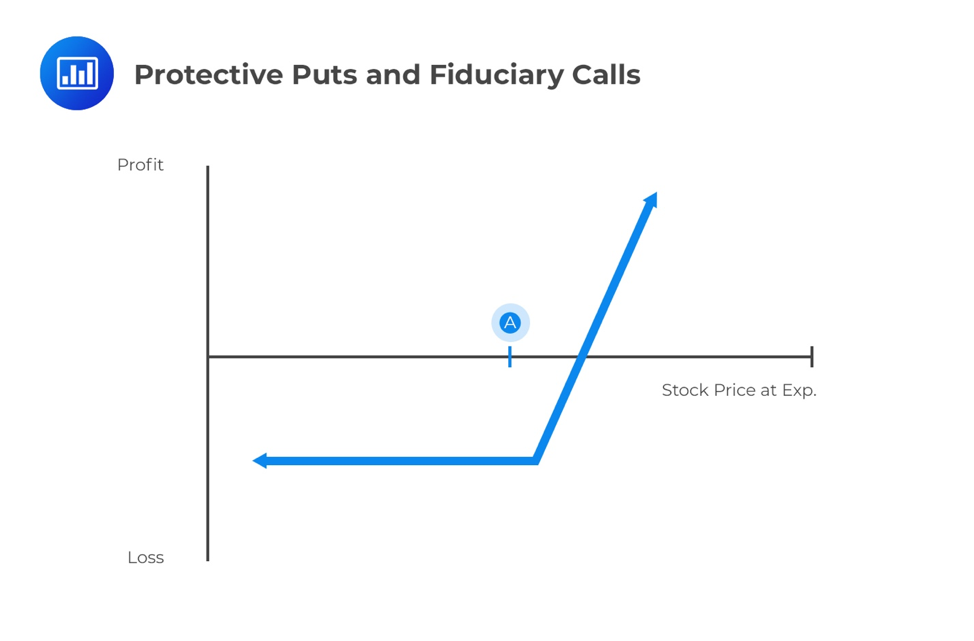

Mechanics of Option Markets CHAPTER 9. Types of Options Ability to Exercise According to Positions Derivative Instrument Basic Options Call Options European. - ppt download

Lower bound for European put option prices -- potential contradiction with BS - Quantitative Finance Stack Exchange

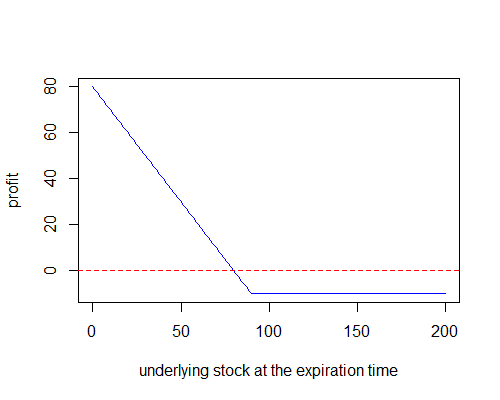

The price of a stock is $40. The price of a one-year European put option on the stock with a strike price of $30 is quoted as $7 and the price of